lump sum vs annuity calculator lottery|Lottery Tax Calculator : Cebu The lottery tax calculator (or taxes on lottery winnings calculator) helps you estimate . Explore a vast collection of high-quality rule 34 images and gifs at R34Hub. Our premier destination offers unparalleled search functions and a wide array of adult content, satisfying diverse fantasies. Enjoy the best in adult entertainment with us.Live results, 1X2, asian odds and asian handicap for livebetting!

lump sum vs annuity calculator lottery,Use the lottery annuity calculator (also a lottery payout calculator) to see how much money you would receive if you opt for lottery annuity payments! In addition, you can .

With the Powerball calculator (which is actually a Powerball payout calculator or .The lottery tax calculator (or taxes on lottery winnings calculator) helps you estimate .lump sum vs annuity calculator lotteryYou can calculate your lottery lump sum take home money, annuity payout and total tax amount that you need to pay after winning from Megamillions, Powerball, Lotto, etc by using our online .

lump sum vs annuity calculator lottery Lottery Tax Calculator With the Powerball calculator (which is actually a Powerball payout calculator or a lottery lump sum vs. annuity calculator), you can estimate how much money you will receive . The lottery tax calculator (or taxes on lottery winnings calculator) helps you estimate the tax amount deducted from a lottery prize and compare the money you would .

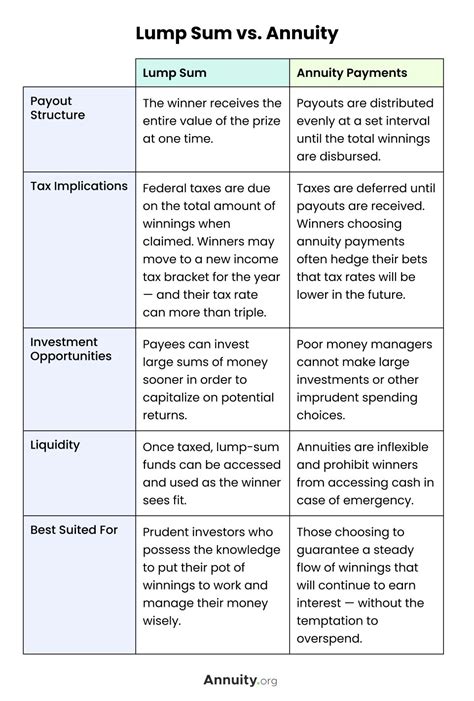

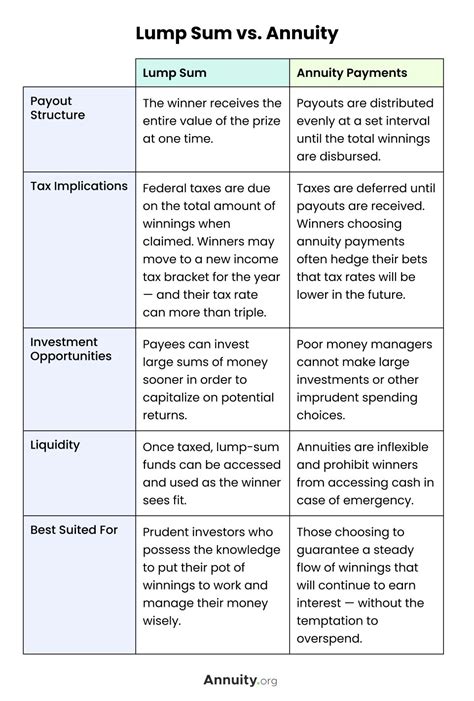

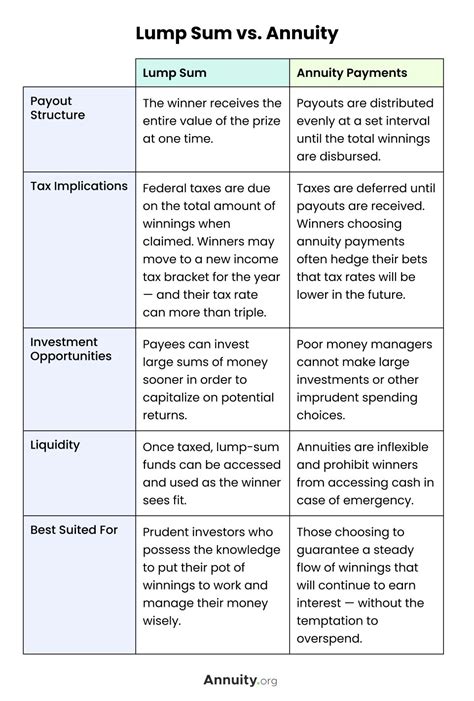

Lottery Tax Calculator Should you choose an annuity or a lump sum payout if you win the lottery? This article explores the pros and cons of each option to help you make an informed decision.

If you win the lottery or have a pension, you may have to choose between a lump sum payment vs annuity. Which one gets you the most money?

Lottery Annuity Payout Calculator. When you hit the lottery jackpot you have the option to choose the cash value (also known as lump sum) - grabbing a single big prize, or .Find out and compare the total payout you would receive if you chose the lump sum or annuity option - followed by a payout chart displaying all 30 annuity payments. To use our Powerball .This calculator provides a clear picture of how much you can expect to receive annually if you choose the annuity option over a lump sum. It calculates the annual payments you would .

Mega Millions payout refers to the payment from winning the Mega Millions lottery jackpot. How does Mega Millions payout? Winners of the lottery can choose to collect their Mega Millions payout amount at once as a lump-sum cash payout or in annual payments as an increasing annuity payout over 30 years.. It is good to learn about the Mega Millions payout .The savings interest rate that you designate is used to calculate present value for the annuity payment option and is compounded monthly. The decision between cash up front and payments over time mostly depends on the interest rate that you can earn on money that you save and the difference between the lump sum amount and the annuity amount.

Lottery Lump Sum Vs. Annuity. Factor Lump Sum Annuity; Immediate Cash: Yes, the entire amount is paid at once. . Lump-Sum Distribution Tax Calculator Lump Sum Distribution Tax Calculator Understanding Tax on Lump Sum Payments When you receive a lump sum payment, particularly from a qualified retirement account, there are several tax . With that added, the lump sum still trumps the annuity after 30 years—by double. From our calculations, the break-even point between the lump sum annuity is at a risk level of about 3.2% annual returns, for both the save-it-all model and the "don't mind if I do" model. Here's a deeper dive into a few other aspects that might affect your decision.

An Annuity vs. Lump Sum Calculator is a financial tool designed to compare the long-term value of receiving a large sum of money all at once (lump sum) versus receiving smaller, regular payments over a period (annuity). . It helps make informed decisions when faced with options like pension payouts, lottery winnings, or large settlements . When you win the jackpot, you can choose between receiving a lump sum or an annuity. Taking the lump sum gives you immediate access to cash, while opting for an annuity means you’ll receive a steady, guaranteed income over time. Payment options may vary depending on the state you win in and the specific lottery game you played.

The Annuity Payout Calculator only calculates fixed payment or fixed length, two of the most common options. Both are represented by tabs on the calculator. Lump-Sum. The lump-sum payment option allows annuitants to withdraw the entire account value of an annuity in a single withdrawal. This can be useful in many cases where the entire value of . At age 65, you can choose between a single life annuity of $1,470 per month ($17,640 per year) for life or a lump-sum payment of $300,000. At first glance the annuity may appear better, as $17,640 per year is equivalent to that $300,000 consistently generating an annual return of 5.9% ($17,640 ÷ $300,000 = 5.9%).

Lottery Payouts: Lump Sum vs. Annuity. When you win the lottery, you have the choice of receiving your prize as a lump sum or as an annuity. We explain how they’re different and the pros and cons of each, so you can pick the right option for you. . Use our lottery calculator to get an estimate of the taxes withheld and find out how much you . Lump Sum vs. Annuity: Which Lottery Payout Is Best? Written by Jackpot Staff. May 7, 2024. When it comes to winning the lottery, one of the first decisions winners have to make is whether to take the prize as a lump sum or as an annuity. Understanding the differences between these two payout options is crucial in determining which one is best .Our lump sum vs. annuity payment calculator compares two payment options: receiving a lump sum today, investing it yourself, and living off the proceeds after paying income taxes; or receiving an annuity for a specific number of years . LUMP SUM: Winners can accept a one-time cash payout. In the case of the $202 million jackpot, the winner could take $142.2 million in cash. In the case of the $202 million jackpot, the winner .The most noticeable difference between the values of the Powerball lump sum vs the annuity is that the cash option is always lower. The advertised jackpot is always stated as the full annuity amount. The annuity payments are graduated, meaning they increase in value every year, taking into account the profits that would be made if the lottery . The Mega Millions jackpot for Tuesday, October 23, was originally estimated at $1.6 billion—which would have been the biggest Mega Millions grand prize ever and the highest lottery jackpot in U.S. history, period.. The grand prize was overestimated, however, and the ticket sold in South Carolina with all six winning Mega Millions numbers wound up with a . Lump Sum vs. Annuity: The way you choose to receive your winnings can impact your tax burden. Taking the lump sum will likely push you into a higher tax bracket for that year. . This outlines the calculation process for a lottery tax calculator online tool: Inputs: Advertised Lottery Winning Amount (USD) State Name (Selected from a dropdown .An annuity cashflow calculator for 30 year durations,showing individual payments, plus the federal and state tax implications. Uses the latest tax tables to assist single and joint tax filers. Can be used for lottery, insurance and investment purposes. Compares lump sum cash versus annuity benefits. Winning the lottery is a dream come true for many, but it also presents an important decision: taking the winnings as a lump sum or the annuity payments. This decision can have significant implications on your financial future, and it's essential to understand the pros and cons of each option before making a choice. Lump

lump sum vs annuity calculator lottery|Lottery Tax Calculator

PH0 · Powerball Calculator: Payout, Tax & Annuity Explained

PH1 · Powerball Calculator

PH2 · Lump Sum vs. Annuity: Which Should You Take?

PH3 · Lottery Tax Calculator

PH4 · Lottery Payout Options: Annuity vs. Lump Sum

PH5 · Lottery Payout Calculator

PH6 · Lottery Annuity Payout Calculator

PH7 · Lottery Annuity Calculator

PH8 · Annuity vs. lump sum payout: Which is better?